| With Dr Manmohan Singh at the helm, economics, it was thought, would dominate politics. But all signs point to the opposite and are exacerbated by the reservation issue, the speed-breakers to infrastructure development, and the Naxal threats. This makes the market rather jittery. |

The stock market mayhem in May has generated endless discussions, most of which fail to understand the nature and role of the stock market. It is important to remember that the market looks at the future. There is a continuous flow of information, both positive and negative, and when the scales are tipped either way, because of information asymmetry or any other reason, the market slides.

India’s markets are highly skewed and shallow and thus the role of foreign institutional investors assumes importance. Though, in aggregate terms, they constitute a small portion of our market, at the margin the influence of the FIIs is considerable.

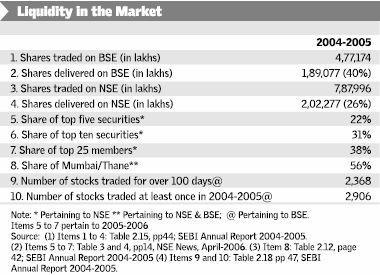

The Table lists some of the salient aspects of the market. In 2004-2005, only 40 per cent of the trade resulted in deliveries at the BSE (26 per cent in the NSE). The picture is no different today. From this one can infer that a substantial proportion of market participants are day-traders who square off transactions during the day. They can also be called margin players. Individual investors only do this as institutions cannot square off within a day in our system and they should settle transactions on a gross basis in the T+2 format.

Actually, we do not know about the aggregate margins provided by individuals to brokers, and the financing of these transactions since, currently, the relationship is between the exchanges and brokers, and the former pull the plug if the latter have not paid the margins or have exceeded their limits.

Skewed market

A substantial portion of these transactions between individuals and brokers is financed by the non-banking financial sector, including moneylenders. Millions of individuals have lost heavily in the recent fall of the market, as they would have borrowed from non-corporate institutions at exorbitant rates.

In the Indian market, though the listed stocks number over 8,000, only around 250 are actively traded. Of these, the top ten securities constitute nearly one-third of the traded value, indicating the level of skew. In most mature markets, normally no single security has more than one per cent of the traded value. This skew makes the market illiquid as everybody wants these ten or so scrips and, when people exit, they also exit from these ten.

Institutional investors, particularly the FIIs, are constantly in search of better returns. The fund manager is paid based on on his performance and his job is to move funds on a continuous basis. Global funds have to think of geographical allocation and then asset allocation between risky shares and risk-less government securities, and the portfolio allocation.

The fund manager is accountable only through his profits and is not emotional about choosing between a developing or a developed country, or between European and Asian markets. If parking funds in Antarctica can fetch gains he will do so with as much vigour as he would in Wall Street or Dalal Street.

The India story has been good and, hence, there was much enthusiasm about the market. When the market touched 12,000, there was so much euphoria that ministers and ruling party managers began to talk about the achievements of the Government. But, unfortunately, markets are more concerned about the future than the past and start getting jittery when politics dominates economic thinking.

Self-goal by government

In April, the Human Resource Development Minister, Mr Arjun Singh, announced reservation of up to 50 per cent in such institutions as IITs and IIMs. After crying from the rooftops that these are premier institutes representing Brand India, this was a bolt from the blue, like an FMCG company downgrading its premium brand. The callous way the decisions were made and the debate was closed would have shocked international investors. This apart, the Minister for Social Justice and Empowerment, Ms Meira Kumar, is talking about reservations in the private sector. Again, nobody in the Government is very clear on this issue.. Fund managers are not sure if this a good move. In the absence of clarity, they prefer to believe the captains of industry that the policy may be harmful to business rather than creating and promoting equity.

The second and most important issue pertains to massive investments in infrastructure — power, water, steel, etc. These are getting blocked due to apathy or antagonism of the governments, both at the Centre and in the States. The NGOs add to the confusion. Classic examples are the Bangalore-Mysore Corridor project, which has become a street brawl between the State Government and the promoters, and the Kalinga project in Orissa, where highways have been blocked for months now.

Naxal threat

And then there is the Prime Minister mentioning that Naxalism is the biggest threat to India. More than 60 districts are affected by it, and these are districts where massive infrastructure investments are expected.

Given the precarious position in Nepal, if it falls to Maoists — then many parts of the Naxal corridor are going to be volatile and almost all the new mega projects expected to come up there will be affected. There is a three-way tug-of-war being played by the UPA, the NDA and the Left, and the market does not appreciate such confused polity. It will be argued that the market had already factored in these variables. But the level of procrastination and the increased domination over economics by politics has been more visible from the end of April.

As a result the market perceives that the Banking Bill, Pension Bill, etc., are all going to be put on the back-burner. Even the fuel price increase is too late and too little and the oil companies may go to the BIFR if they continue to bleed. The suppressed inflation is a matter of concern as retail inflation could touch double digits by the festival season. The corresponding increase in interest rates will also be more pronounced.

The market cannot be talked up or down, as it is popularly believed. If the Government tries to artificially push up the market by encouraging financial institutions to buy, it will be folly of the highest order as public institutions such as banks and LIC will be saddled with stocks not worth the paper they are printed on. Neither the enthusiasm of ministers regarding the ” robustness of our economy reflected in the increasing index” nor the complaint that ” the fall in index is manufactured” is justified.

The present dispensation at the Centre is increasingly looking like a rudderless ship, with no clear course charted for the future. Everybody hoped with a team headed by Dr Manmohan Singh at the helm, economics would dominate politics. But, unfortunately, the signs increasingly indicate the opposite . That is not something the market appreciates. It makes the market rather jittery. The well-known practitioner of the dismal science of economics, Prof Bibek Debroy, puts it well: “In these days of the Da Vinci Code and anagrams, that an anagram for the “UPA government” is ” Repugnant Move” just about sums up the market perception of the Government role.”